41 ytm for coupon bond

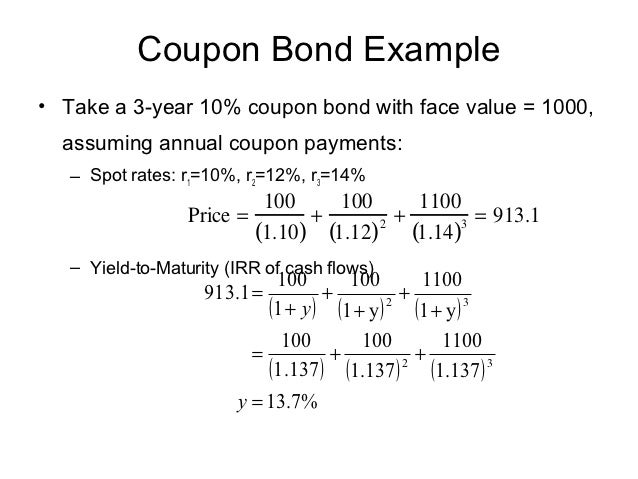

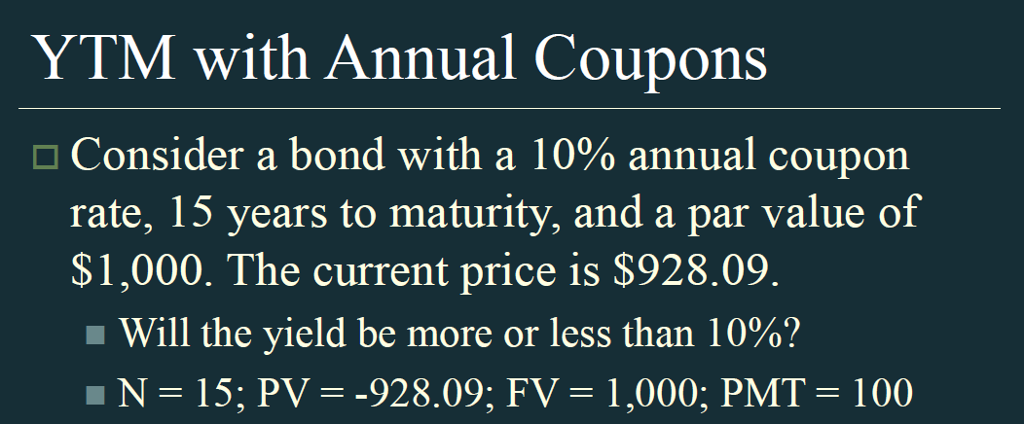

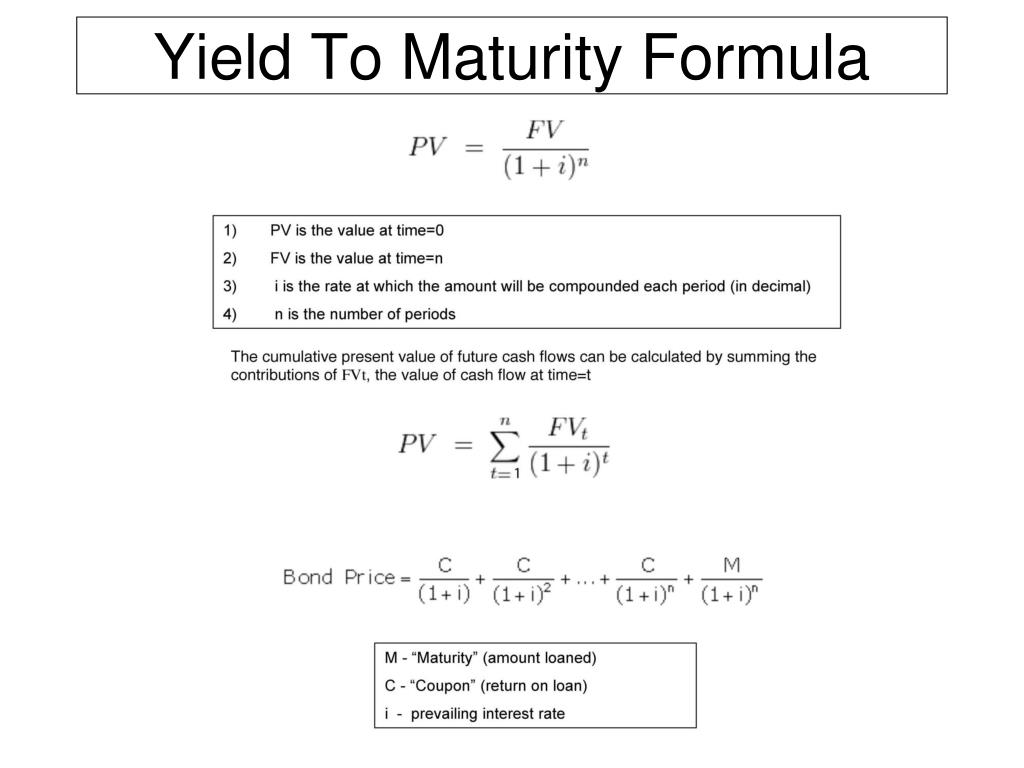

bond - Why does the YTM equal the coupon rate at par? - Quantitative ... Intuitively and academically, a bond cannot be worth more than the sum of the future cashflows plus future value. In the case of yield equaling coupon rate, the price is equal to par because the rate at which you are discounting makes it so that the sum of the discounted cashflows and discounted par equal present par. Understanding this, by ... Yield to Maturity Calculator | Calculate YTM The n for Bond A is 10 years. Calculate the YTM; The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where:

Yield to Maturity | Formula, Examples, Conclusion, Calculator Yield to Maturity Examples. The bond has a price of $920 and the face value is $1000. The annual coupons are at a 10% coupon rate ($100) and there are 10 years left until the bond matures. What is the yield to maturity rate? The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%.

Ytm for coupon bond

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Mathematically, the coupon bond formula is represented as, Coupon Bond = C * [ (1- (1 + YTM))^ (-n))/ YTM ]+ [P/ (1 + YTM)^n] where, C = Coupon payment P= Par value YTM = Yield to maturity n = Number of periods until maturity Examples Following examples are given below: Example #1 How to calculate yield to maturity in Excel (Free Excel Template) RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%.

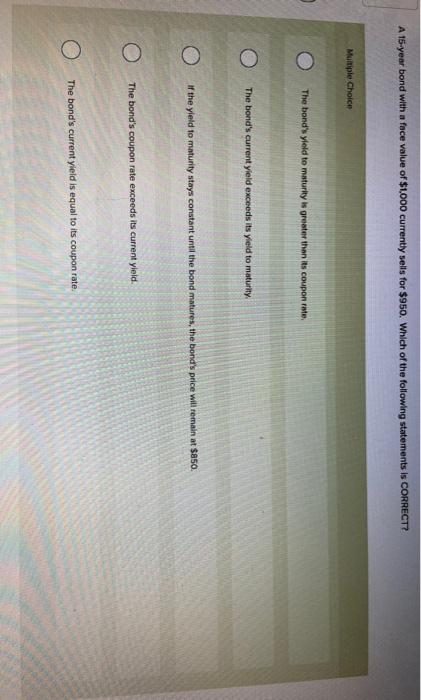

Ytm for coupon bond. Bond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) A single security - ucc.uczelni3.pl Jan 21, 2022 · A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to maturity. Bond Pricing: Yield to Maturity. Bonds are priced to yield a certain return to investors. A bond that sells at a premium (where price is above par value The Returns on a Bond - YTM - The Fixed Income The yield to maturity of a bond might not be the same as the coupon, or interest rate paid out on the bond. ... price considers that between the current rate of 8% and the coupon of 10% there are Rs. 20 extra that will be paid as a coupon on the bond, and Rs. 13.42 less than the amount paid now that is received on maturity. ... When is a bond's coupon rate and yield to maturity the same? - Investopedia For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ...

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, What is YTM in bonds? - Fintrakk YTM or yield to maturity is an effective way to find out the exact return that a bond offers when held till maturity. The YTM of bonds changes with the change in the purchase price of the bond. Even if a bond has a fixed coupon rate payable on the face value, the effective yield depends on at what price one purchases it. Detailed Answer Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of YTM We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands that are trading in the US market. Current Yield vs. Yield to Maturity - Investopedia Bond Yield as a Function of Price When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate. Conversely, when a bond sells...

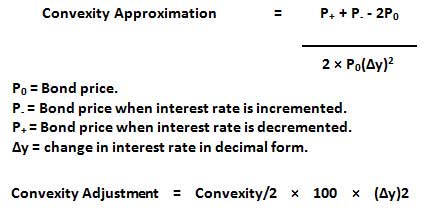

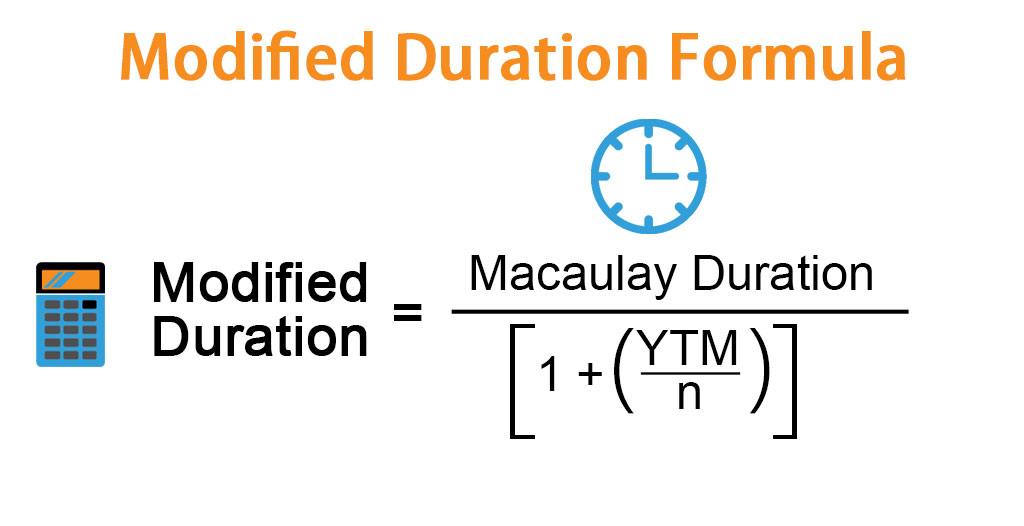

Zero-coupon bond YTM - ZuoTi.Pro - HomeworkLib Bond Y has a 30-year maturity, an 8% coupon, and sells at an initial yield-to-maturity (YTM) of 8 percent. The modified duration of Bond Y is 11.26 years and its convexity measure equals 212.40. If the bond's yield increases from 8% to 10% how much on a percentage basis is the Duration-With- Convexity Rule more accurate (Part 1)? Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion. How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2. Yield to Maturity (YTM) Definition - Investopedia To calculate YTM here, the cash flows must be determined first. Every six months (semi-annually), the bondholder would receive a coupon payment of (5% x $100)/2 = $2.50. In total, they would...

Yield to Worst (YTW): Formula and Bond Calculator [Excel Template] Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)" By contrast, the YTC switches the "maturity" to the first call date and "redemption" to the call price, which we'll assume is set at 104.

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. 2. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years. The coupon payment is $100 ( ).

Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. The zero coupon bond formula is as follows: Yield to Maturity Calculator

Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Now, what if you bought the security in the secondary market?

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of...

Post a Comment for "41 ytm for coupon bond"