41 what is the coupon rate

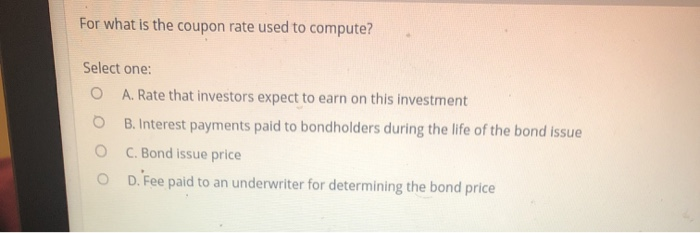

Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Coupon Rate vs Interest Rate. The main difference between Coupon Rate and Interest Rate is that the coupon ... What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

What is the coupon rate

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons. Coupon Rate | Investor.gov Coupon Rate The interest rate on a bond. It is expressed as a semi-annual rate. Individual - Treasury Notes: Rates & Terms 3.99%. 4.25%. 102.106357. Above par price required to equate to 3.99% yield. Sometimes when you buy a Note, you are charged accrued interest, which is the interest the security earned in the current interest period before you took possession of the security. If you are charged accrued interest, we pay it back to you as part of your next ...

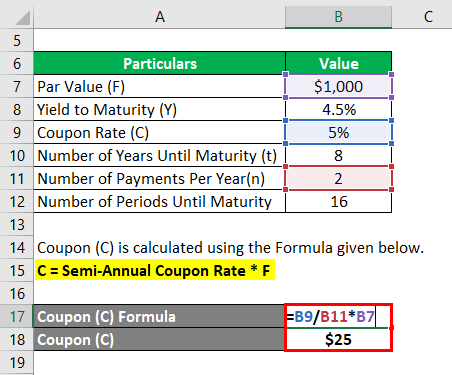

What is the coupon rate. Coupon Rate of a Bond (Formula, Definition) | Calculate ... Coupon Rate is referred to the stated rate of interest on fixed income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more securities such as bonds. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the same. What is the Coupon Rate? | IIFL Knowledge Center A coupon rate is the rate of interest paid on the face value of a bond, by the issuer, to the bondholder. For instance, if the 5-year bond with a face value of Rs. 100 is traded in the market at... Discount Rate Formula | How to calculate Discount Rate with ... Discount Rate = 2 * [($10,000 / $7,600) 1/2*4 – 1] Discount Rate = 6.98%; Therefore, the effective discount rate for David in this case is 6.98%. Discount Rate Formula – Example #3. Let us now take an example with multiple future cash flow to illustrate the concept of a discount rate.

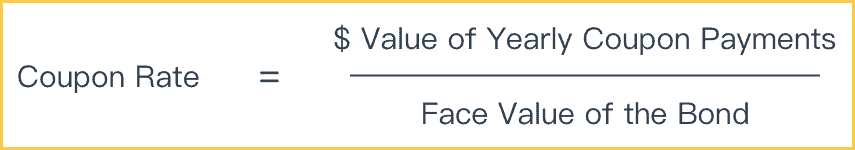

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ... WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ... Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

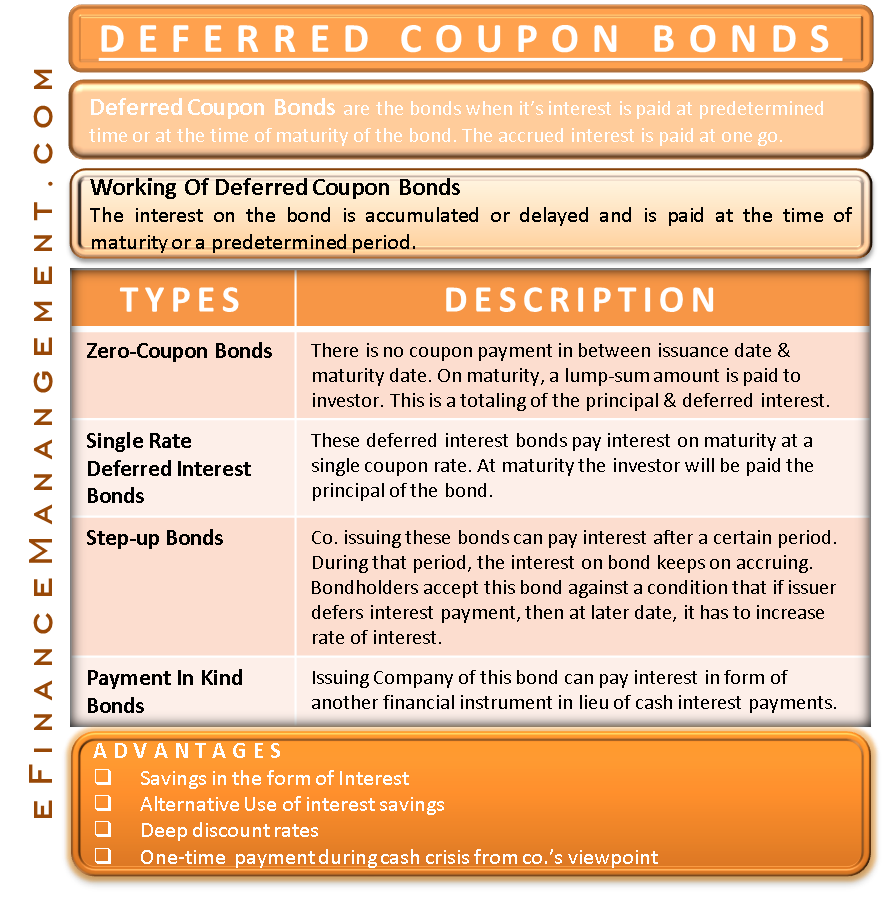

Gold Rate Today in India Sep 20, 2022 · Latest India Gold Rate (INR/gram) India Time. Market is open! Updated 20 September 2022 What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Coupon rate financial definition of Coupon rate - TheFreeDictionary.com Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision As discussed, a coupon rate is a fairly straightforward rate that measures the percentage of interest rate that an investor will receive periodically from the bond issuer. However, the yield to maturity is slightly complicated. To understand yield to maturity, we must be familiar with some characteristics of a bond as follows:

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

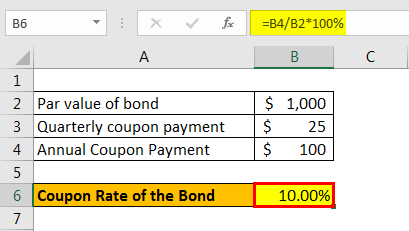

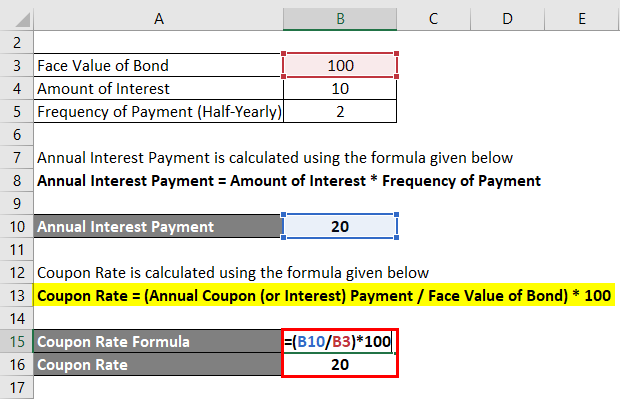

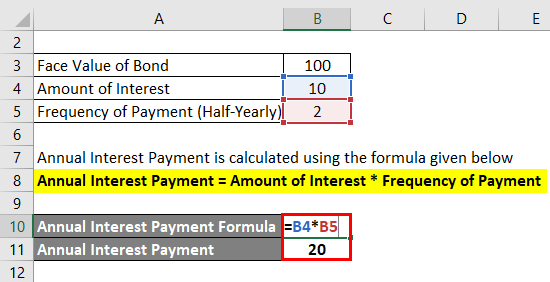

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

What is the Coupon Rate? - Realonomics The coupon rate is the interest payments that are made to bondholders, annually or semi-annually, as compensation for loaning the issuer a given amount of money. 6 For example, a bond with par value of $1,000 and a coupon rate of 4% will have annual coupon payments of 4% x $1,000 = $40. Where is the coupon rate on a BA II Plus?

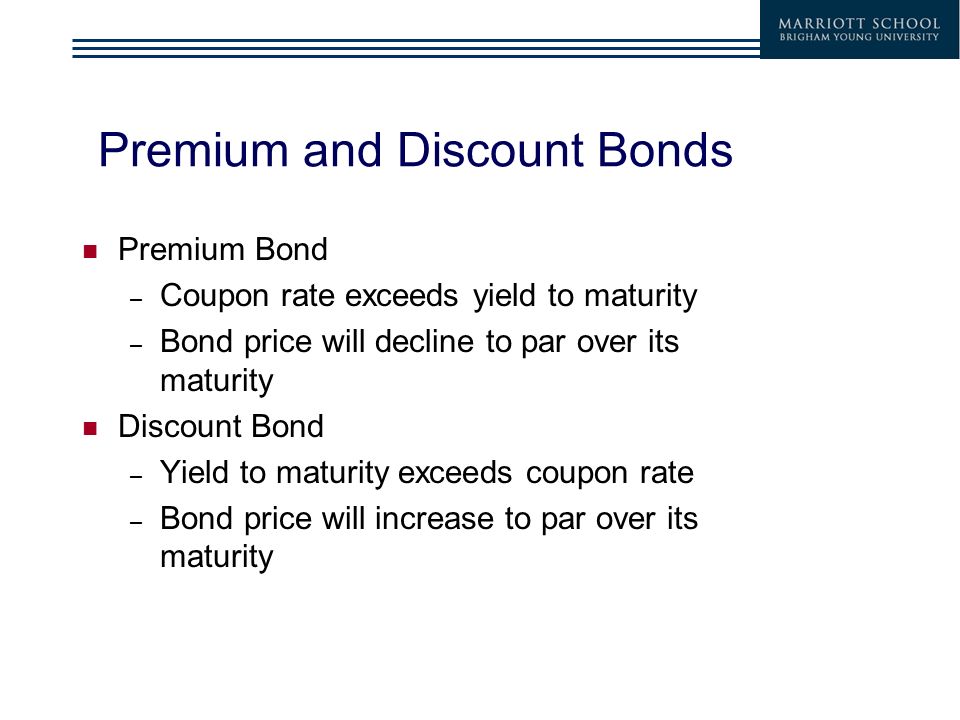

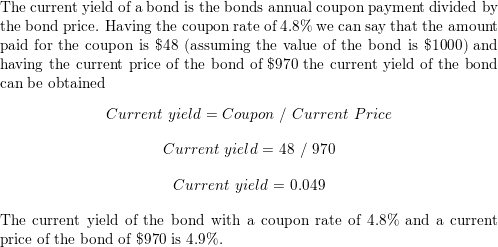

What Is a Coupon Rate? And How Does It Affects the Price of a Bond ... The coupon rate is also called coupon payment. It is the yield the bond paid on its issue date. The yield changes when the value of the bond changes. Such a case results in giving the bond's yield to maturity. In the case of the booming market, the coupon holder yields lesser than the prevailing market conditions as bonds won't pay more.

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate is the interest the bond issuer pays to the bondholder on an annual basis. In other words, it is the return an investor can expect from their bond investment. This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail. Scripbox Recommended Goals

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon Statistics - 2022 Update | Balancing Everything These coupon facts can help businesses reach higher average coupon redemption rates and step up their marketing game. (Valassis) 19. Over 80% of people from any income group look for coupons. American shoppers from any income group want to snatch the best shopping deals. Any of the income groups note high coupon redemption rates and lots of users.

What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula The coupon rate calculations formula is simple.

What is the difference between coupon rate and market - Course Hero A coupon rate is the yield paid by a fixed income security, a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bonds face or par value. The coupon created the yield the bond paid on its issue date. The yield changes as the value of the bond changes, thus giving the bonds yield to ...

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

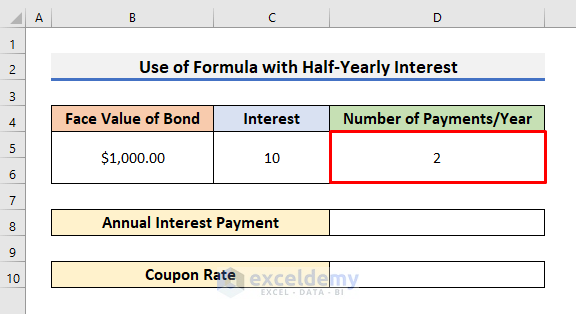

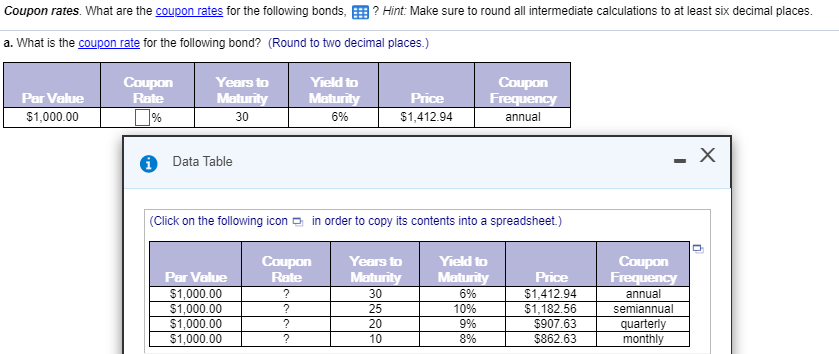

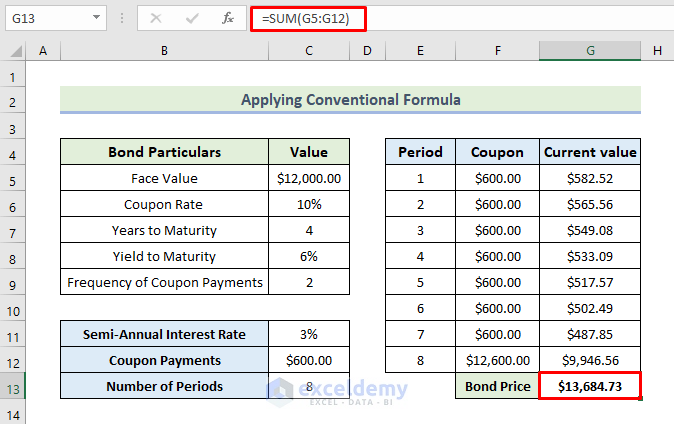

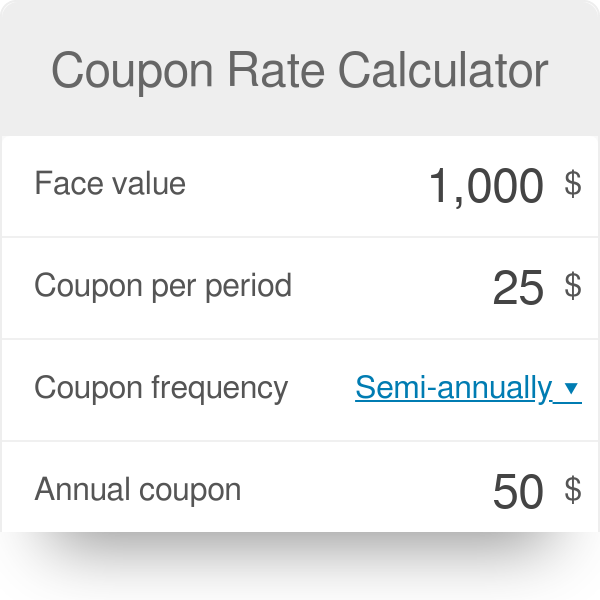

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates play a significant role in dictating demand for certain bonds. They come fixed at the time of issuance, while interest rates change. This means the two work in tandem to drive bond prices—and thus, demand for bonds. If the rate is higher than the current interest rate, bonds will trade at a premium.

Individual - Treasury Notes: Rates & Terms 3.99%. 4.25%. 102.106357. Above par price required to equate to 3.99% yield. Sometimes when you buy a Note, you are charged accrued interest, which is the interest the security earned in the current interest period before you took possession of the security. If you are charged accrued interest, we pay it back to you as part of your next ...

Coupon Rate | Investor.gov Coupon Rate The interest rate on a bond. It is expressed as a semi-annual rate.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 what is the coupon rate"